Are you planning your estate? It is one of the best things you can give to yourself and the loved ones. When you know that your valuable assets and prized possessions will go to whom you have chosen, it offers great peace of mind.

It’s an excellent gift to family and friends who won’t have to make tough, stressful decisions during a difficult time of grieving. Estate planning is not complicated with South Dakota will forms.

1# Write a Will

Estate planning starts with having a Last Will. In the absence of it, you will be considered intestate. In such a case, the government will distribute assets as per the laws of the estate. Such distribution may not necessarily be in your best interest. The first step is to write a Will. For that, you need to start creating a list of all the assets and who you would like them to receive them.

2# Name a Guardian for Minor Kids

If you have minor kids, you can use the Last Will to name a guardian for them if you die or on the death of the other parent. Minor kids also need someone to handle property or other inherited assets. So, ensure that you have named someone to handle the financial affairs of your kids too.

3# Leave an Advance Directive

It is a legal document. It contains your instructions regarding the medical care you wish to receive if you become incapacitated or seriously ill and cannot communicate your preferences. You can also include instructions regarding the use of life-sustaining measures like feeding and breathing tubes.

4# Create a Power of Attorney

Using a power of attorney, you can choose the authority to decide if you can’t. When you create your POA, give the person the authority to make healthcare decisions and a durable POA to handle the finances. You can have more than one agent to handle different things. Anyone can be the agent, and he does not have to be an attorney.

5# Consider a Living Trust

It is a written legal document using which you can keep the assets in a trust. You can use them throughout your lifetime and then transfer them to desired beneficiaries after the demise. The ‘successor trustee’ completes the formalities. The main benefit of living trusts is that property containing withing them doesn’t go through probate. Instead, it goes to the beneficiaries directly. It means significant savings for loved ones.

6# Update the Names of Correct Beneficiaries

Ensure that all of the beneficiaries that you name in the Last Will trust are correct. When you name a beneficiary on the bank or retirement account, those funds can be paid upon your death to the named beneficiaries instead of having to go through the probate process. It would save your beneficiaries from undue pain.

7# Meet Your Tax Obligations

If you own an estate whose value is above USD 11.18 million, it could be subject to federal estate taxes. However, most estates will not owe any federal estate taxes. If you are close to this number, you should ensure that your taxes are covered. As there are no death and inheritance taxes in South Dakota, they will not affect your estate.

8# Leave Instructions About the Remains

A funeral is a considerable expense, and you can avoid trouble for loved ones by arranging ahead of time. You can pre-pay for your funeral.

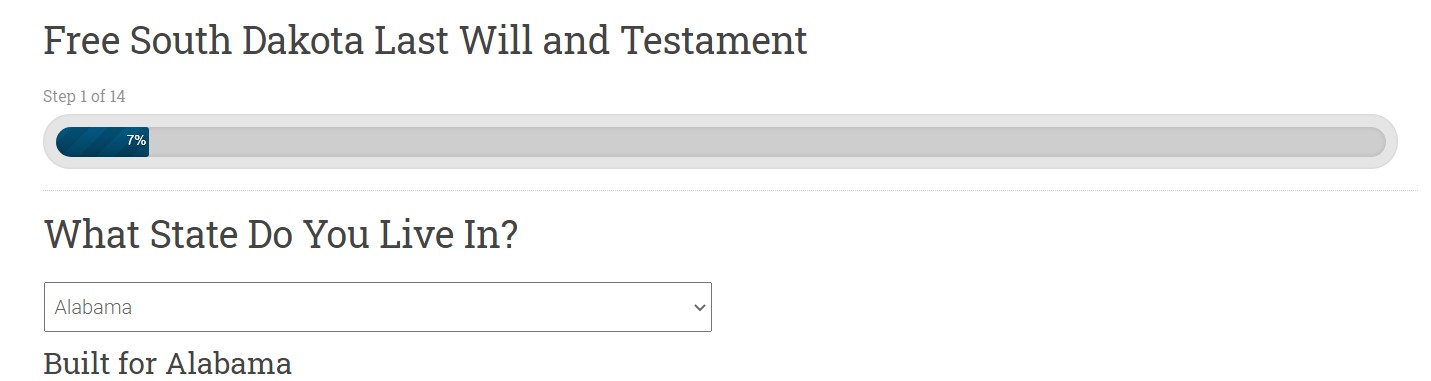

How forms.legal Helps In Your Estate Planning?

Last will and testament South Dakota forms are available for free at our site. Sign up now and start your estate planning before it is too late!