Sample Hawaii Partnership Agreement

Basics of a Partnership Agreement in Hawaii

Hawaii’s Business Registration Division makes the process of starting a business partnership a painless process with its easy-to-navigate site that gives you the best business registration process.

Though comprehensive, anyone looking to set up a partnership with a strong foundation will soon realize that the process doesn’t include the filing of the partnership agreement. The reason for the omission is that this document is not a mandatory document required by the state. However, we recommend getting started on this document as you work on the other documents since this document is the legally enforceable document that could stop a partner from taking on debts on behalf of the partnership without the consent of the rest of the partners, but most importantly, it may be the guiding principle if a dispute arises.

Therefore, even as the Department of Commerce and Consumer Affairs omits this important document, it would be a wise move for you to draft a partnership agreement underlining the rules and the regulations that your new company will operate under.

How to Create a Partnership Agreement

Also known as a partnership contract, a business, or a general partnership agreement, the partnership agreement is a legally binding agreement that layout out the terms on which your partnership will operate.

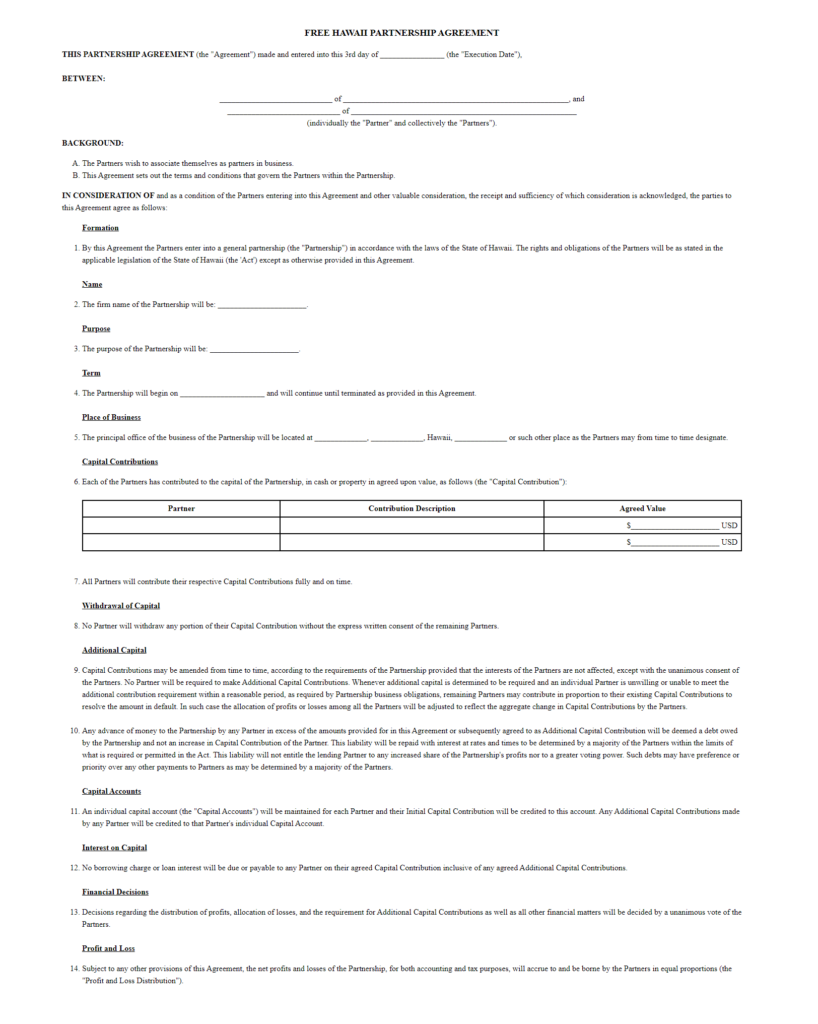

This document doesn’t require notarization, and you can prepare it with ease by downloading our free Hawaii partnership agreement form. This form or sample partnership agreement guides you on the essentials of the partnership contract in a bid to ensure that your partnership is protected. The contract essentially outlines the roles, responsibilities, and relationships of the partners and the partnership.

What’s Included in the Partnership Contract?

Your partnership agreement in Hawaii contains information regarding the business (name, purpose, and duration), the details of the business partners, as well as the profit and loss distribution, among other important sections.

-

1. Financial Rights

Perhaps the most important section in the partnership agreement, this section on the financial right, covers the different financial aspects of the partnership. And with finances as one of the most contentious issues where businesses are involved, you’d also see why this section carries much weight. Some of the clauses included in this section mainly cover the financial rights and responsibilities of the partners.

-

- Individual capital contributions of the partners and the rights of each partner

- Whether all partners are expected to contribute the same amount of cash and capital

- Whether all the partners have equal rights/ responsibilities or if their rights are based on the partner’s contributions/ profit shares

- Allocation of the profits and losses

- Whether the partner(s) taking up more managerial roles, get a bigger chunk of the profits or not in comparison to other partners, and by how much.

- This section also addresses partners draws of the profits/ capital from the partnership, and whether the partners are allowed to make 100% draws or not (the acceptable percentage to be specified).

-

-

2. Partner Authority

If your partnership is a general partnership, it means that all the partners receive equal authority and control over the day-to-day. However, with your partnership likely being a limited partnership, then it means that the partners don’t have equal rights or authority over the day-to-day operations of the partnership, and you may have one partner taking up more roles/ responsibilities if they are named to take on managerial roles.

That said, this section of the partnership contract should outline the responsibilities of all the partners, the limitations of the partners, as well as the roles and responsibilities of the managing partner.

Note that with regards to the partner’s limitations, it only means that one partner may not undertake some actions, such as taking debt on behalf of the other partners or the partnership at their own discretion. In other cases, the limitation applies when the partner lacks the qualifications to take on certain roles or responsibilities. For example, the tax matters representative would be the partner with experience and the necessary skills on taxation matters.

-

3. Dispute Resolution

Since some of the disputes among the partners might be very significant, calling for the involvement of an independent party, this section should include a mediation clause. The mediation clause would compel the partners to involve a mediator or arbitrator who’d review the dispute and help the partners in dispute come to a resolution.

Keep in mind that the other reason why dispute resolution via mediation is important is that it’s better than the alternative – going to court.

-

4. Partner Withdrawal or Death

This section stipulates the steps and the measures to be instigated in the event of a partner’s death, for example, property division or the involvement of beneficiaries, as well the terms and conditions to be met by a withdrawing partner.

This section would also include provisions for partnership buyout.

-

5. Dissolution of Partnership

In this section, the conditions or events that would necessitate the dissolution of the partnership are stipulated.

To get started with your partnership agreement in Honolulu, Lahaina, Kailua, Kailua-Kona, Hilo, Kaneohe, Lihue, Waimea, Laie, or any other city on Hawaii, download our free partnership agreement form here today.

Sample

HI Partnership Agreement

Personalize your Hawaii Partnership Agreement template.

Print or download in minutes.