Sample New Hampshire Partnership Agreement

Partnership Agreement in New Hampshire: How to Create Effective Partnerships

Despite holding immense potential for success, partnerships are often the breeding ground for conflict, broken and irreparable friendships, essentially because everyone things they are chief or because all the partners promise to treat each other equally, making everyone chief. The unfortunate bit about this line of thought is that the resultant ego is often too much for anyone to handle, especially with everyone wanting to be in control.

In this article, we’ll look at the steps you must take if you are going to create the most effective/ successful partnership business.

But first, a brief look at the reasons behind partnerships:

-

-

Smart and talented individuals choose to form partnerships in a bid to leverage the power of their pooled skills and talents in ways that best meet the market needs.

-

Consultants not so great at sales partner with great salespeople (rainmakers) to create more stability in the business.

-

Partnerships are believed to be more fun than solo businesses.

-

Unfortunately, these reasons are never enough for the success of partnerships, and in most cases, they result in failure. Below, we highlight some of the common reasons for failed partnerships.

Reasons for Failed Partnerships

If you don’t admit that some of the things you are doing could be the reason why your partnership won’t succeed, then you will be going down the road to failure. So, learn from the mistakes of others and chart a more successful path for your business. Here are the most common reasons why partnerships fail:

-

-

Lack of concise definitions for the partnership’s vision and the reason for its existence, beyond the business being your vehicle to more money. Yes, money is an attractive goal, but your values, life goals, and career are more important.

-

Lack of clear decision-making processes. All partners need to agree on making the right decisions to guide the strategic needs and also the direction of the business partnership.

-

Financial structures that encourage personal, rather than the partnership’s success

-

Lack of clear definition of partners’ roles and authority, as well as the extent of their involvement and absence of non-competition rules. In such cases, the rainmakers may hold the partnership hostage by threatening to take their clients with them.

-

Failure comes from the quitting of the rainmaker

-

Lack of a sense of camaraderie/ loyalty to the other partners and the partners incapable of playing well together.

-

Now that we’re aware of the main reasons why partnerships fail let’s look at the things you could do to create a successful/ effective partnership business. Thanks to these tips, you should be able to run a successful partnership business, whether you are partnering with your friends or family members.

How to Create A Successful Partnership

Come up with strong structures

A look at the reasons for partnerships failure, above, reveal one glaring reason for the failure of partnerships – the absence of strong structures.

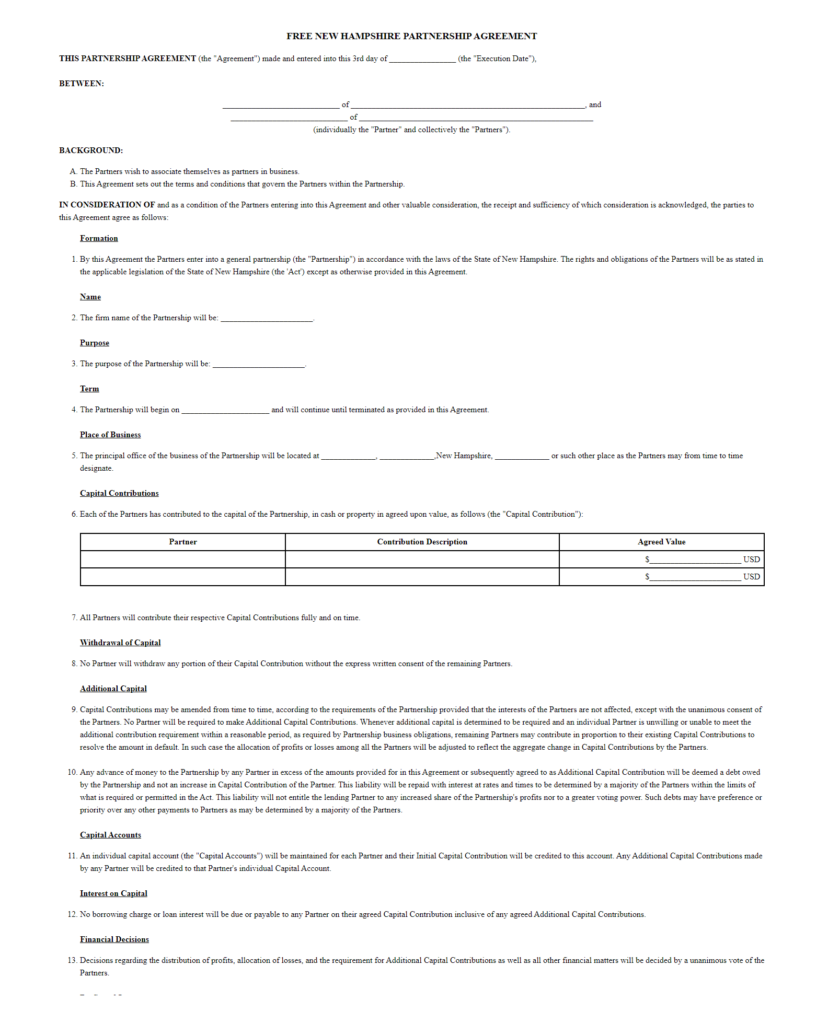

Well, we’ll help you get around that with our free New Hampshire partnership agreement form. Agreements/ contracts bind the parties to a partnership as it outlines the rights of each partner while clarifying the roles and the responsibilities of each partner, as well as the relationships between the partners and the partnership, and among the partners.

The partnership agreement in New Hampshire, also called the partnership contract or the general/ business partnership agreement, refers to the legally binding instrument that stipulates the rules, roles, right, and relationships of a partnership. It is the backbone of every partnership.

With the legal partnership agreement, essential aspects of partnerships are defined, provisions are put in place, and once each party to the partnership signs the document, it becomes enforceable, even without notarization. But what makes this document that powerful?

Well, here are the most important clauses covered in the partnership:

-

-

Financial matters– capital contribution, distribution of profits and losses, handling additional capital contribution, capital draws, etc.

-

Partner authority and involvement– this clause specifies the things that partners can do, the contracts they can enter into on behalf of the partners and the partnership, and also limitations to the authority of the partners. Regarding partners' involvement, the partnership specifies the things that the partners can do, the hours put in, vacation days, sick offs, and, most importantly, the activities that the partners get to engage in, out of the partnership business. Non-competes could also be discussed here. Don’t forget to incorporate provisions for compensation to the rainmakers and the partners who contribute more than the others.

-

Exit strategies– this section of the partnership agreement specifies the terms of partner exit, the conditions that would necessitate the dissolution of the partnership, and also the buyout or new partner admission procedures.

-

Dispute dissolution– with partnerships getting terminated because of irreconcilable differences, this clause outlines the steps to be initiated for dispute resolution. Essentially, there would be a mediation clause. This clause instructs the partners to engage a mediator or arbitrator to help resolve conflict.

-

In addition to the agreement, here are the other important aspects of your partnership that you must work on to ensure its success.

-

-

Come up with a simple but clear process for decision making

-

Have in place a compensation structure that includes salaries and other forms of compensations

-

Only partner with people you share the same vision, values, and goals

-

Be very clear about the partnership’s end goal

-

Set clear guidelines on everything! And work on nurturing relationships in the partnership.

-

To get started right and to ensure that your structures work well, we recommend getting a sample partnership agreement form. Whether you are in Concord, Manchester, Nashua, Portsmouth, Derry, Keene, or any other city in New Hampshire, you can download our free partnership agreement form here to get started with the due process today.

Sample

NH Partnership Agreement

Personalize your New Hampshire Partnership Agreement template.

Print or download in minutes.