Sample Connecticut Partnership Agreement

Essentials of The Partnership Agreement in Connecticut

Written contractual engagements, unlike handshake and verbal agreements, are legally binding and enforceable. As long as it’s written, then the parties to the contract cannot go back on their words (thoughts or beliefs).

Partnerships are on top of the list of the arrangements that require the preparation of legally binding agreements. Even though the state of Connecticut doesn’t make it obligatory for business partnerships to have partnership agreements, we recommend preparing this document before you get started – it’s just as important as the type of partnership you agree on.

Partnership Agreement in Connecticut

Also called a business partnership agreement, a partnership contract, or a general partnership agreement, the partnership agreement in Connecticut represents the legally binding contract between partners or people going into business together. Although it isn’t a mandatory document required by the state, it guides the operation of the business by stipulating the sets of rules that govern the business operations.

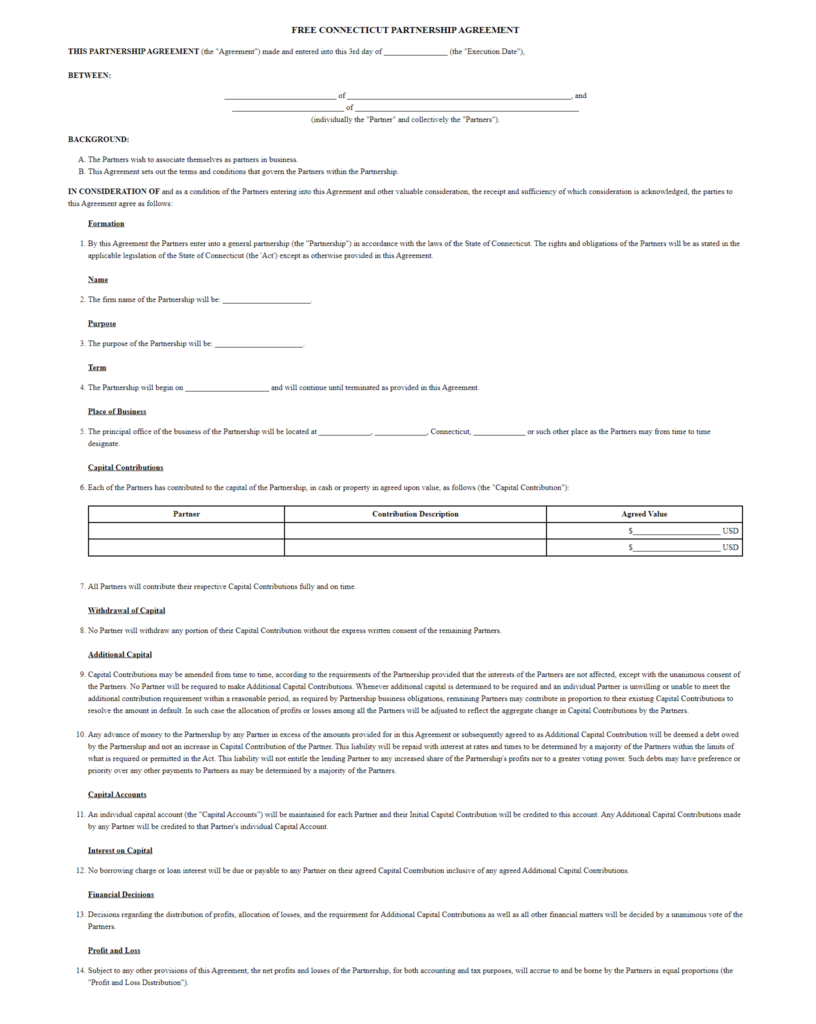

In spite of this being a legal instrument, you will be happy to note that you don’t need a lawyer to prepare it or the notary public to notarize it. The cherry on the cake – we have a free Connecticut partnership agreement form here for you to download, edit, and print. This free partnership agreement template contains all the necessary clauses your partnership needs to run smoothly from day one.

Partnership Contract Essentials

Financial Matters – Rights and Contributions

Most business partnership agreements will address the financial rights of the partners, as well as their financial obligations in the partnership, with the absence of a clause that addresses financial matters spelling trouble for the partnership’s future.

In this clause, some of the items addressed include:

-

- The partner contributions and whether all the partners make the same amount of contributions to the partnership (cash and capital contributions)

- The allocation/ distribution of the profits and losses – is the distribution based on a fixed percentage, an equal share, or is the distribution based on the partner’s capital contributions?

- Are some partners, for example, the managing partner and the tax matters representative, allocated a bigger share of the business profits?

- Do partners with higher capital contributions get a bigger chunk of the profits?

Partnership Authority

Generally, it is assumed that all the partners in a partnership (general) have equal rights/ authority over the daily affairs of the business. However, this is hardly the case, especially for LLPs, where there is a managing partner in charge of the day-to-day operations of the partnership.

As a result, the partnership contract must outline the authority of the partners, while also stipulating who, when, why, and how a partner can enter into a legally binding agreement on behalf of the partnership or the partners.

This clause further sets the limitations to the partner’s authority with these limitations based on different elements such as the partner’s lack of the relevant qualifications or even the partner’s unwillingness to take certain responsibilities.

On top of these, the responsibilities of the managing partner and the tax representative are also outlined.

Voting

-

- How will the partners vote? Do all partners get equal voting rights, and if not, how are the voting rights allocated – voting proportionate to the capital contributions or the profit shares?

- Which large decisions or big picture matters require voting?

- Do partners get to vote on matters such as bringing in a new partner?

- Which matters require the minority/ majority vote?

- Generally, this section of the partnership stipulates the situations that require voting, as well as the vote required for a decision to be made.

Dispute Resolution

Disputes between partners could easily break the partnership, which is why a clause on dispute resolution is essential. Besides setting out general guidelines on dispute resolution, the real spanner in the works would be the inclusion of a mediation clause to necessitate the involvement of a third-party mediator or arbitrator to help resolve the matter. Note that the incorporation of a mediation clause significantly diminishes and even eliminates the probability of the partnership going to court to settle issues.

Withdrawal or Death of Partners

The partnership contract also needs to include a provision of the steps to be taken in the event of the withdrawal of partnership or the death of a partner. One of the important things to be covered here is how the deceased’s share of the partnership estate will be divided and how the heirs will come in.

Also, this clause stipulates whether the deceased heir can have a stake in the partnership, how much and if their stake can be purchased by the existing partner(s).

Dissolution of Partnership

The conditions for the dissolution of the partnership should be addressed here. They include:

-

- The death of a partner

- Project’s completion

- The bankruptcy of the partners or partnership

- Steps to take during the dissolution of the partnership

The other clauses you could include clauses on partner involvement and competition, and buyouts.

To get started with your partnership agreement today in Hartford, Stamford, Norwalk, New Haven, Danbury, Manchester, Middletown, or any other city in Connecticut, download our free partnership agreement form here.

Sample

CT Partnership Agreement

Personalize your Connecticut Partnership Agreement template.

Print or download in minutes.