Sample Colorado Partnership Agreement

Essentials of the Partnership Agreement in Colorado

The ultimate survival and the success of your business partnership will, for the biggest part, depend on the foundational structures you put in place. These ground rules, though appearing superfluous when you are setting up a partnership as childhood friends or family members, will be the only principles that determine how and for how long the business runs, especially if disputes arise.

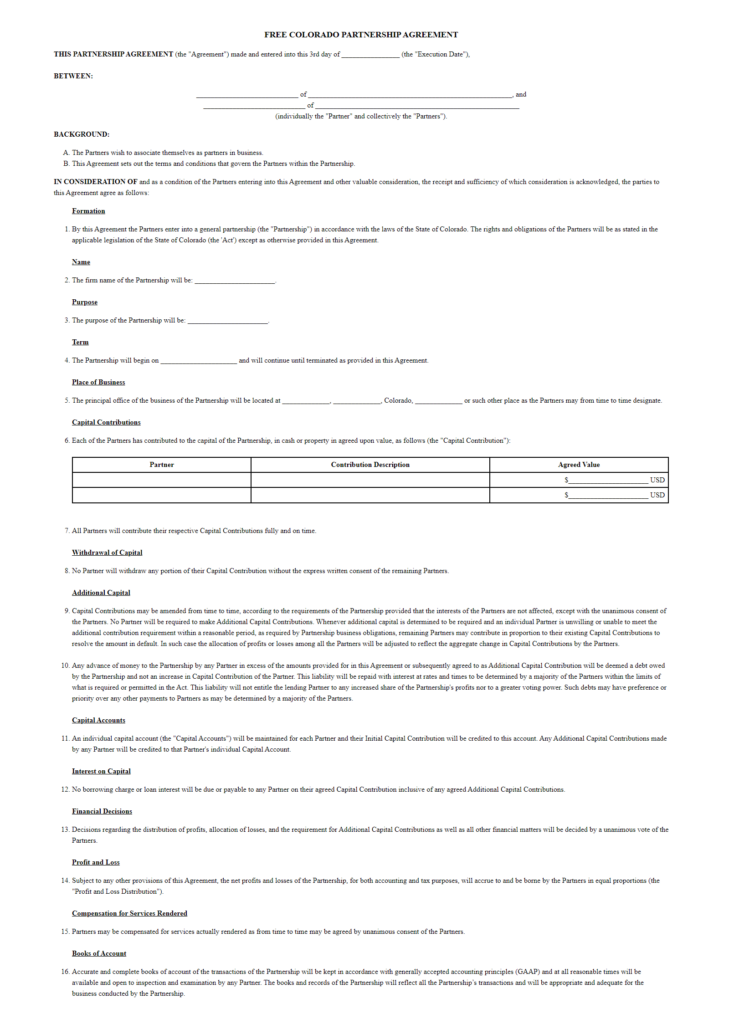

To help you lay down the rules that will govern your partnership is the partnership agreement, also called a general partnership agreement, a partnership contract, a business partnership agreement, or articles of partnership.

A partnership contract refers to the contract established between two or more people/ business partners with the intention of establishing the responsibilities, rules, roles, and relationships for (and between) the partners. In essence, this contract covers important aspects such as the distribution of profits and losses, while outlining the processes to be followed (governing guidelines) on matters such as withdrawal/ cessation of partnership and financial reporting, among other functions.

Understandably, it all sounds like quite a bit of work that would require expert help and guidance. But the good news is that you don’t have to hire a lawyer to help you through the particulars of the agreement, thanks to our free Colorado partnership agreement form. This form is structured in a simple format that makes the creation of enforceable and legally binding agreements effortless.

With each downloadable (editable and printable) sample partnership agreement, you get to update it to match your partnership needs.

Below, we look at some of the important clauses of a partnership agreement in Colorado.

Essentials of a Partnership Agreement in Colorado

While partnership agreements are not required by law in the state of Colorado or that you don’t have to get the document notarized for it to be enforceable, this contract must address different elements of the partnership, whether they feel contentious or not.

Review of the Partnership Terms

In addition to naming the business partners and listing the partnership’s date of formation, this section also reviews and lists the different activities of the partnerships, the duration/ term of the partnership, as well as the purpose of the partnership.

Allocation of Profits and Losses

This section is the most important section of the partnership contract as it outlines the allocation of profits and losses between the partners.

Here, the contract outlines whether the profits and losses of the partnership will be shared equally or based on the cash and the capital contributions of each partner.

The importance of this section is that it not only clears the air regarding how much who gets, it also covers the reasons why. For example, if one of the partners takes up the role of the managing partner (meaning they are responsible for the day-to-day operations of the partnership, and they generally control much of what happens), then it means that the equal allocation might not be the best approach.

Besides the equal shares approach, the other profits/losses allocation strategy would be the fixed percentage approach or the allocation based on the proportion of capital contributions.

Management and Authority

In this clause, the management of the partnership is outlined, with the designated managing partner and their roles outlined. Often, the designation of the managing partner is based on experience, but there are cases where the managing partner is chosen through voting – majority or unanimous vote.

Besides the managing partner, the tax matters partner/ representative is also named in this section, and their roles and responsibilities outlined.

By specifying the roles of each partner, the business partnership is set to kick off on the right foot, but most importantly, the partners are protected against liability. In this case, the partners with authority to enter into binding contracts with other individuals or companies, on behalf of the partnerships are named. Limitations to the authority given are also clarified, as well as the conditions to be met before getting into such contracts.

Thanks to this clause stipulating the authority of the members, other partners are protected from liability should the partner act in a manner that could bind the partnership.

Voting

This clause stipulates the conditions for voting, whether different things will be approved via unanimous or majority voting.

Voting and voting powers could also be determined through methods like voting proportional to profit shares, contributions, or each partner could have an equal vote.

Dispute Resolution

With disputes being the leading cause of failed partnerships, your legal partnership agreement template also comes with a dispute resolution clause. Dispute resolution is crucial, and we recommend getting a mediation clause in this contract to ensure the professional and easy resolution of disputes.

Partners’ Withdrawal

What conditions should a partner meet before withdrawing their partnership? How is the partner’s share handled? Can a partner’s stake be bought by the remaining partners? Would a managing partner’s withdrawal of partnership necessitate the dissolution of the partnership?

Partnership Dissolution

Besides dissolving the partnership on the agreed partnership’s end date, the partnership contract stipulates the other conditions that would necessitate the partnership’s dissolution. These conditions would include:

-

- Achievement of the partnership’s goals/ Completion of the project

- Death of a partner

- Bankruptcy

- Withdrawal of a partner.

These are some of the clauses you must have in your business partnership agreement. You can alter the clauses as you deem fit for your business.

If you are taking steps to establish a business partnership in Boulder, Aurora, Denver, Brighton, Castle Rock, Grand Junction, Lafayette, or any other city in Colorado, download our free partnership agreement form here, to get started.

Sample

CO Partnership Agreement

Personalize your Colorado Partnership Agreement template.

Print or download in minutes.