Sample Indiana Partnership Agreement

Reasons Why Every Business Partnership Needs a Partnership Agreement in Indiana

A business partnership, like a personal partnership, involves two or more parties who need to communicate their understandings clearly. While most of the personal agreements tend to be communicated verbally and in other cases, through handshakes, a business partnership should be done in writing.

Even with business partnerships between siblings, spouses, or friends, disagreements arise all the time; without a written contractual agreement or a contract laying out the rules of engagement, the business could fall apart easily. A change in partnership or the demise of a partner could also leave the business partnership on shaky ground, hence the need for a partnership agreement. The business partnership agreement means fewer unknowns, and you don’t have to grapple with many ‘What if’ situations that could set things falling off the tracks.

The partnership agreement, through its provisions on different sections, stipulates the steps to be taken by the partners to resolve disputes or to effectuate changes.

Remember that the partnership agreement is also called a business partnership agreement, a partnership contract, or a general partnership agreement, and it represents the legally-binding contract between the partners (individuals/ organizations) in a partnership. This contract sets out essential terms and conditions governing the relationships between/ among the partners.

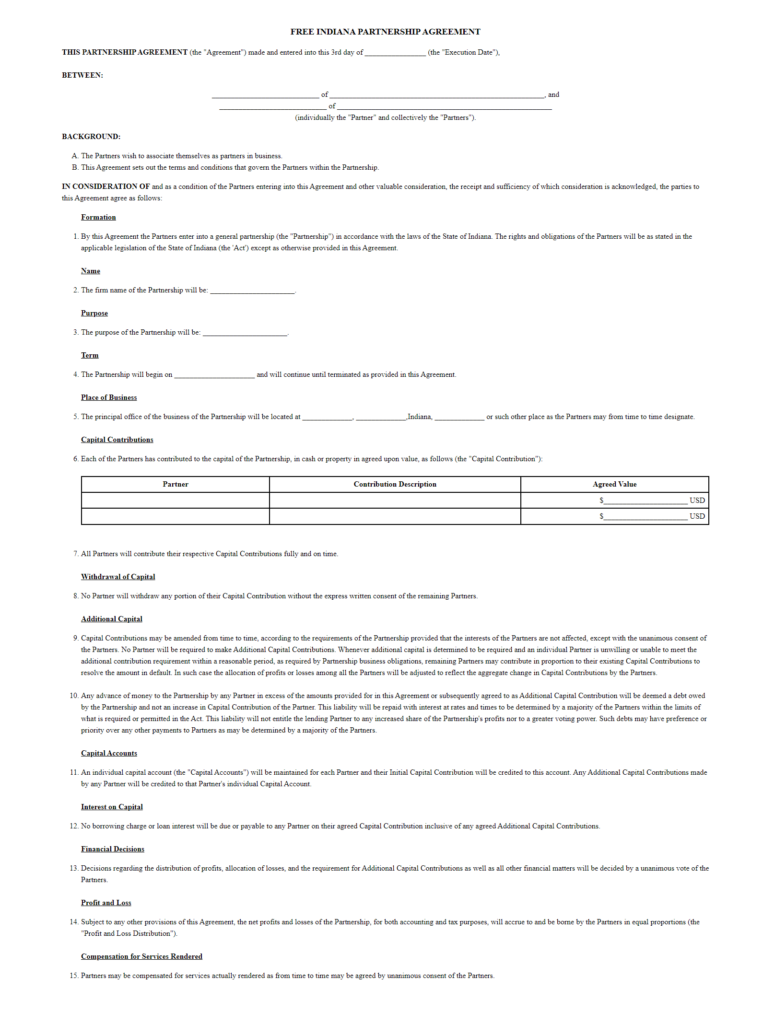

If you are in talks about establishing a partnership contract in the next few days or weeks, you could start things off by constituting your partnership agreement in Indiana using our free Indiana partnership agreement form. This form is editable, downloadable, and printable, and its enforcement isn’t subject to notarization – it needs the signatures of the partners only, for its enforcement in the state.

Essentials of a partnership agreement in Indiana

The contract binding the partners to the partnership contains terms and conditions that apply to the following areas:

-

- Name of the business partnership, purpose, and location

- Name of partners

- Each partner’s percentage ownership

- Capital and cash contributions

- The ratios for the distribution of the profits and losses

- Recovery of losses

- The duration (term/length) of the partnership

- Management and day-to-day running of the partnership

- Decision making and matters that can only be passed through voting

- Voting rights of the partners

- The financial books, procedures, and approved methods for financial recording

- Terms and conditions for bringing in new partners

- Process of partner termination

- Partner buyout

- Dispute resolution

- Partners involvement and competition

- Death of a partner

- Termination of the partnership

- Winding-up procedures for the partnership

Importance for the Partnership Agreement

When a business has more than one owner, the partnership contract is crucial for the business operations as it sets out expectations, while offering direction to things that might happen in the future.

In the absence of a well laid out business partnership contract, the contentious matters of the partnership might end up in court, where the judge may take weeks or months to issue a ruling on the matter. Therefore, to save time and money, you should prepare a partnership contract in advance.

Below, we look at the reasons why every business partnership must draw up a partnership contract from the start.

-

It outlines the roles and responsibilities of all the partners while describing how decisions regarding the appointment of a managing partner or the tax management partner were reached. Besides outlining the roles and the obligations of the managing partner, the contract should also stipulate the individual responsibilities of the named partners.

-

Avoidance of liability and legal issues – by laying out the personal liability of each partner in the contract, most disputes will be avoided when a partner decides to exit the partnership if the partnership comes to its end, or when the partnership is canceled. It’s also important to note that the liability of a partner differs depending on the type of partner one is – the extent of legal/ personal liability is different for general and limited partners.

-

Prevention of tax issues – first, the tax status of the partnership structure must be explained with the profits’ distribution ratios explained based on the acceptable accounting and tax practices.

-

Ease handling changes – by anticipating changes, the agreement addresses different what-ifs regarding changes to the life of the partnership and its structure. Changes like illness, death, or divorce affect partnerships, and a partnership contract lays out the steps that would be followed if any of these things happen.

-

The partnership agreement in Indiana would also help deal with partner issues such as conflicts of interest, as well as non-competes.

-

Dispute resolution is also simplified

-

The partnership contract would also override state laws, hence the requirement for the use of specific language in the agreements.

To curate an enforceable partnership agreement in Evansville, Indianapolis, Fort Wayne, South Bend, Bloomington, Carmel, Kokomo, Fishers, Valparaiso, Gary, or any other city in Indiana, download our free partnership agreement form.

Sample

IN Partnership Agreement

Personalize your Indiana Partnership Agreement template.

Print or download in minutes.