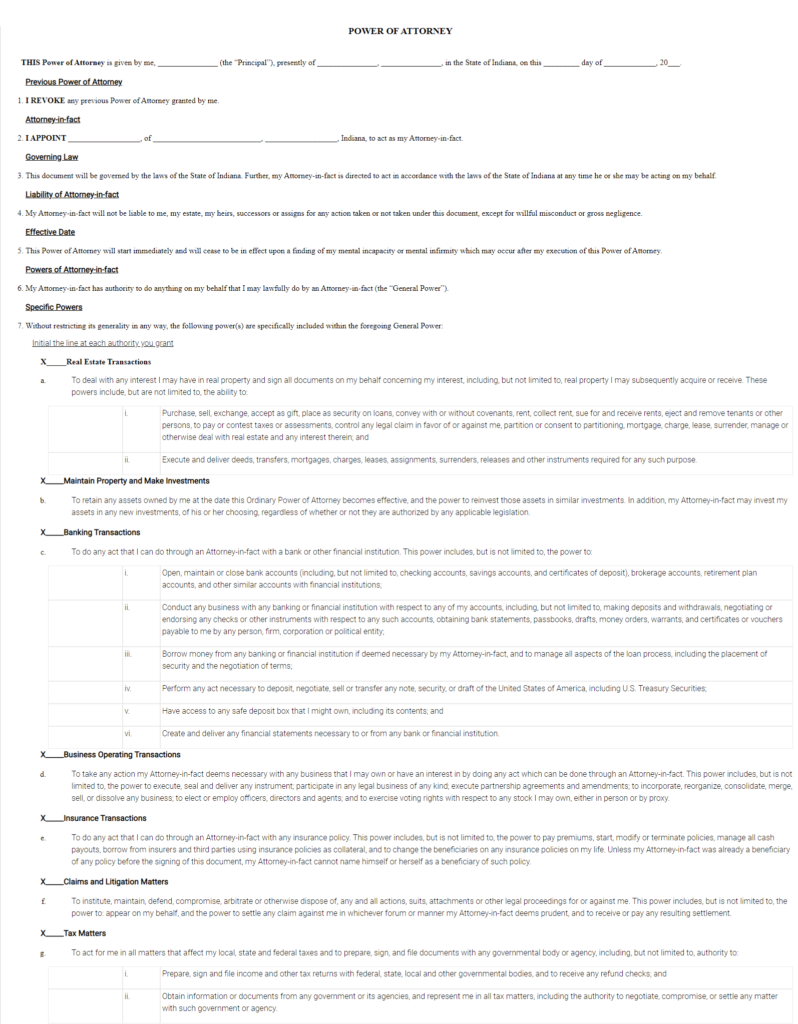

X_____Real Estate Transactions

To deal with any interest I may have in real property and sign all documents on my behalf concerning my interest, including, but not limited to, real property I may subsequently acquire or receive. These powers include, but are not limited to, the ability to:

|

|

i.

|

Purchase, sell, exchange, accept as gift, place as security on loans, convey with or without covenants, rent, collect rent, sue for and receive rents, eject and remove tenants or other persons, to pay or contest taxes or assessments, control any legal claim in favor of or against me, partition or consent to partitioning, mortgage, charge, lease, surrender, manage or otherwise deal with real estate and any interest therein; and

|

|

|

ii.

|

Execute and deliver deeds, transfers, mortgages, charges, leases, assignments, surrenders, releases and other instruments required for any such purpose.

|

To retain any assets owned by me at the date this Ordinary Power of Attorney becomes effective, and the power to reinvest those assets in similar investments. In addition, my Attorney-in-fact may invest my assets in any new investments, of his or her choosing, regardless of whether or not they are authorized by any applicable legislation.

To do any act that I can do through an Attorney-in-fact with a bank or other financial institution. This power includes, but is not limited to, the power to:

|

|

i.

|

Open, maintain or close bank accounts (including, but not limited to, checking accounts, savings accounts, and certificates of deposit), brokerage accounts, retirement plan accounts, and other similar accounts with financial institutions;

|

|

|

ii.

|

Conduct any business with any banking or financial institution with respect to any of my accounts, including, but not limited to, making deposits and withdrawals, negotiating or endorsing any checks or other instruments with respect to any such accounts, obtaining bank statements, passbooks, drafts, money orders, warrants, and certificates or vouchers payable to me by any person, firm, corporation or political entity;

|

|

|

iii.

|

Borrow money from any banking or financial institution if deemed necessary by my Attorney-in-fact, and to manage all aspects of the loan process, including the placement of security and the negotiation of terms;

|

|

|

iv.

|

Perform any act necessary to deposit, negotiate, sell or transfer any note, security, or draft of the United States of America, including U.S. Treasury Securities;

|

|

|

v.

|

Have access to any safe deposit box that I might own, including its contents; and

|

|

|

vi.

|

Create and deliver any financial statements necessary to or from any bank or financial institution.

|

To take any action my Attorney-in-fact deems necessary with any business that I may own or have an interest in by doing any act which can be done through an Attorney-in-fact. This power includes, but is not limited to, the power to execute, seal and deliver any instrument; participate in any legal business of any kind; execute partnership agreements and amendments; to incorporate, reorganize, consolidate, merge, sell, or dissolve any business; to elect or employ officers, directors and agents; and to exercise voting rights with respect to any stock I may own, either in person or by proxy.

To do any act that I can do through an Attorney-in-fact with any insurance policy. This power includes, but is not limited to, the power to pay premiums, start, modify or terminate policies, manage all cash payouts, borrow from insurers and third parties using insurance policies as collateral, and to change the beneficiaries on any insurance policies on my life. Unless my Attorney-in-fact was already a beneficiary of any policy before the signing of this document, my Attorney-in-fact cannot name himself or herself as a beneficiary of such policy.

To institute, maintain, defend, compromise, arbitrate or otherwise dispose of, any and all actions, suits, attachments or other legal proceedings for or against me. This power includes, but is not limited to, the power to: appear on my behalf, and the power to settle any claim against me in whichever forum or manner my Attorney-in-fact deems prudent, and to receive or pay any resulting settlement.

To act for me in all matters that affect my local, state and federal taxes and to prepare, sign, and file documents with any governmental body or agency, including, but not limited to, authority to:

|

|

i.

|

Prepare, sign and file income and other tax returns with federal, state, local and other governmental bodies, and to receive any refund checks; and

|

|

|

ii.

|

Obtain information or documents from any government or its agencies, and represent me in all tax matters, including the authority to negotiate, compromise, or settle any matter with such government or agency.

|

To act on my behalf in all matters that affect my right to allowances, compensation and reimbursements properly payable to me by the Government of the United States or any agency or department thereof. This power includes, but is not limited to, the power to prepare, file, claim, defend or settle any claim on my behalf and to receive and manage, as my Attorney-in-fact sees fit, any proceeds of any claim.

To act for me and represent my interests in all matters affecting any retirement savings or pension plans I may have. This power includes, but is not limited to, the power to continue contributions, change contribution amounts, change investment strategies and options, move assets to other plans, receive and manage payouts, and add or change existing beneficiaries. My Attorney-in-fact cannot add himself or herself as a beneficiary unless he or she is already a designated beneficiary as of the signing of this document.

To make whatever expenditures are required for the maintenance, education, benefit, medical care and general advancement of me, my spouse and dependent children, and other persons that I have chosen or which I am legally required to support, any of which may include my Attorney-in-fact. This power includes, but is not limited to, the power to pay for housing, clothing, food, travel and other living costs.

To purchase, sell or otherwise deal with any type of personal property I may currently or in the future have an interest in. This includes, but is not limited to, the power to purchase, sell, exchange, accept as gift, place as security on loans, rent, lease, to pay or contest taxes or assessments, mortgage or pledge.

To do any act that I can do through an Attorney-in-fact with regard to all matters that affect any trust, probate estate, conservatorship, or other fund from which I may receive payment as a beneficiary. This power includes the power to disclaim any interest which might otherwise be transferred or distributed to me from any other person, estate, trust, or other entity, as may be appropriate. However, my Attorney-in-fact cannot disclaim assets to which I would be entitled, if the result is that the disclaimed assets pass directly or indirectly to my Attorney-in-fact or my Attorney-in-fact's estate.

To transfer any of my assets to the trustee of any revocable trust created by me, if such trust is in existence at the time of such transfer. This property can include real property, stocks, bonds, accounts, insurance policies or other property.

To make gifts to my spouse, children, grandchildren, great grandchildren, and other family members on special occasions, including birthdays and seasonal holidays, including cash gifts, and to such other persons with whom I have an established pattern of giving (or if it is appropriate to make such gifts for estate planning and/or tax purposes), in such amounts as my Attorney-in-fact may decide in his or her absolute discretion, having regard to all of the circumstances, including the gifts I made while I was capable of managing my own estate, the size of my estate and my income requirements.

To continue to make gifts to charitable organizations with whom I have an established pattern of giving (or if it is appropriate to make such gifts for estate planning and/or tax purposes), in such amounts as my Attorney-in-fact may decide in his or her absolute discretion, having regard to all of the circumstances, including the gifts I made while I was capable of managing my own estate, the size of my estate and my income requirements.

To appoint and employ any agents, servants, companions, or other persons, including nurses and other health care professionals for my care and the care of my spouse and dependent children, and accountants, attorneys, clerks, workers and others for the management, preservation and protection of my property and estate, at such compensation and for such length of time as my Attorney-in-fact considers advisable.

X_____Manage Real Estate

To manage the property owned by me, or in which I have an interest, located at _____________________________________________________, and municipally known as _____________________________________________________. This power includes, but is not limited to, the power to receive rents, make repairs, pay expenses including the insuring of the property and generally to deal with my property as effectually as I myself could do; to take all lawful proceedings by way of action or otherwise, for recovery of rent in arrears, or for eviction of tenants; and to commence, carry on and defend all actions, suits and other proceedings touching my property or any part of it.

To control my accounts with ____________________ Bank, located at _________________________________________, Account Number(s)__________________________________________. This power includes the authority to conduct any business with respect to any of my listed accounts, including, but not limited to, making deposits and withdrawals, negotiating or endorsing any cheques or other instruments with respect to any such accounts, obtaining bank statements, passbooks, drafts, money orders, warrants, and certificates or vouchers payable to me by any person, firm, corporation or political entity, and to perform any act necessary to deposit, negotiate, sell or transfer any note, security or draft.