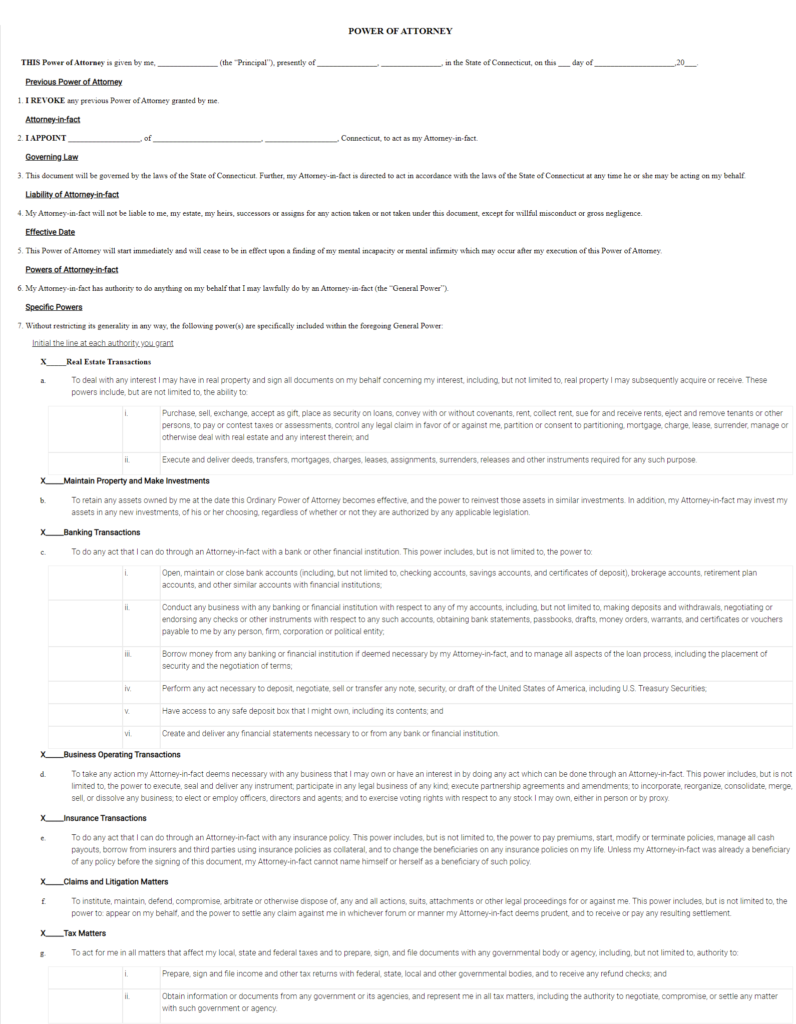

Sample Connecticut Power of Attorney

What is a Connecticut Power of Attorney and How is It Used?

Most people think of estate planning only after retirement or if something happens to their health prompting them to draft, edit, sign and notarize legal documents to guide decisions should they get sick or become incapacitated for other reasons. Though it is the right move, no one assures you that you won’t need someone else to decide if you are hooked to a ventilator and for how long if you get into a car accident at 35.

It is, therefore, essential that you to prepare the right documents and entrust the right people with your estate and medical affairs even if you are to live until you hit 100. The legal documents ensure that the decisions implemented are as per your wishes.

Power of attorney

A power of attorney is the legal document that authorizes your entrusted agent with control over your affairs. Your trustee could sign checks in your place, consent to medical procedures/ treatment, file your returns, pay bills, manage, buy or sell real estate, or even handle legal claims. That is a lot of power to entrust someone else, don’t you think? Well, that is the reason why the document is only executable once it is in writing, signed and then notarized with witnesses present.

The powers of attorney are either limited or specific, and they are executable upon your incapacitation/ unavailability (springing) or executable immediately after signing (non-springing).

For legal reasons, the person giving out authority is the principal and the person who is granted power is the agent or the attorney-in-fact.

With these considerations in mind, here are the main types of powers of attorney.

Connecticut Limited Power Of Attorney Law

If you wish to grant an agent power that’s limited to specific matters, you can get this document signed and notarized. The agent will act in your place when you are unable to or unavailable.

A revocation notice takes power from the agent. The notice should be in writing and delivered to the agent and third parties affected by the new directive.

Connecticut Durable Power of Attorney Laws

To avoid legal battles and associated financial losses, you need to plan ahead. You need to determine and appoint a trustworthy person as the executor of the big decisions relating to your health care. For this, the state of Connecticut requires you to have a durable letter of authorization document (DPOA).

The DPOA will guide your family members if you are brain dead and hooked to machines. This document is the legal instrument that lets you appoint a legal health care proxy giving them a letter and power of authorization should anything happen to you.

The legal requirements for this document are contained in the Code Sections of the General Statutes of Connecticut in Chapter 368w which handles matters relating to the Withdrawal of Life-Supporting Systems

The powers of the Connecticut DPOA

The agent executing the health care letter of attorney may give consent or not, or even withdraw total consent to all medical treatments and procedures for the treatment of patients, other than treatments making the principal comfortable.

But, as you fill that free power of attorney form in Connecticut, know that the powers under the durable health care letter of attorney aren’t executable directives for pregnant patients until they give birth or if the child dies.

-

The Execution of the durable POA – Legal Requirements

-

-

The agent needs to be 18 years or older.

-

The principal and 2 witnesses present must sign the POA during the processing of the document. But, the agent cannot be a witness.

-

The document also needs to be notarized.

-

Legalities for revocation of the health care POA directives

Despite having direct directives outlining the wishes of the principal, the principal can revoke the document any, the revocation process notwithstanding.

A divorce, annulment, or a legal separation revokes the document automatically unless the agent gives specific directions.

Interstate Validity

For power of attorney documents prepared in different states, they remain active if they came into being through the valid channels according to the laws of the state or if they are in accordance with the Connecticut statutory laws. The document should not contradict the public policy in Connecticut.

If an attending physician is unwilling to comply with their patient’s directives communicated by the agent, they are to act promptly, transferring the incapacitated patient to another doctor or medical facility.

Immunity to attending physicians

-

While filling out your free Connecticut power of attorney form, beware of the fact that an attending physician who removes or withholds life-sustaining systems for the incapacitated patient will not be professionally, criminally, or civilly liable if:

-

-

They decided to act after considering their best judgment medically.

-

If the principal has a terminal medical condition

-

They considered the principal’s best interests and wishes.

-

Connecticut POA For Bank Account Matters Law

This is a special power of attorney document that grants the agent executable powers over the principal’s bank account matters. The powers are executable upon incapacitation or unavailability of the principal, and they are revocable (in writing and notice sent to third parties). This document is an adoption of the Uniform POA act of 2016.

If you’d like to give another person authority over your affairs in Bridgeport, New Haven, Stamford, Hartford, Waterbury, Norwalk, Danbury, New Britain, West Hartford or any other city within the state of Connecticut, we have your free power of attorney form easily available online. Fill out the form above to get started.

Sample

CT Power of Attorney

Personalize your Power of Attorney template.

Print or download in minutes.