Is it challenging for you to handle the finances on your own? Is incapacitation stopping you? It’s time to consider giving durable power of attorney to someone to manage the finances.

POA is a simple and inexpensive way to allow someone trusted to handle the finances when you are incapacitated or if you can’t be present or if you are unable to do so.

Power of attorney is a legal document with which you can authorize someone to act on your behalf. The person giving the authority is called ‘grantor’. The person who will act on behalf of the grantor is called as ‘agent’. Another term for the agent is ‘attorney-in-fact’.

About Financial Power of Attorney

A financial power of attorney is a particular type of POA that authorizes your trusted agent to act on your behalf in matters related to finances. A durable power of attorney form Missouri is available at Forms. Legal and most states have their official forms.

Creating a Financial Power of Attorney

You can create the financial POA at Forms. Legal without incurring any costs. Here are some details that will be needed by Missouri power of attorney forms.

Start with selecting the state ‘Missouri and the power of attorney form will get customized according to rules and regulations of the state.

POA Form

If you make it a Springing POA, you can decide when a power of attorney will come into effect. Otherwise, it comes into effect when you sign it. Mention the date in case of the Springing POA.

Who will grant a power of attorney? Provide the Name, Address, City/Town, and State of the grantor.

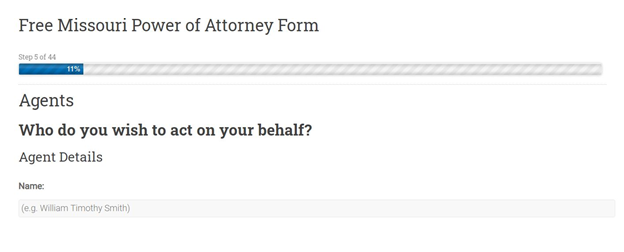

Whom do you want to act on your behalf? Give the details of the agent. Name, Address, City/Town, and State. If there are more than one agents, give the details of each of them.

You can also assign an alternate agent who can act for you when the primary agent is not willing to act on your behalf.

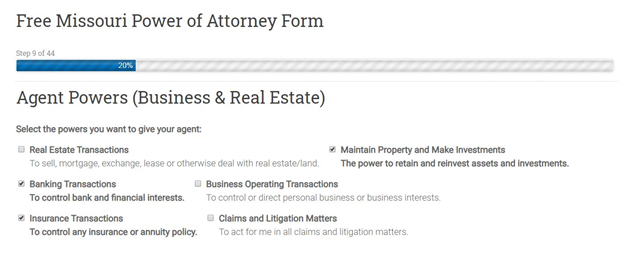

Now you must select the powers you want to give your agent. For financial POA you should choose:

-

- Banking Transactions

- Insurance Transactions

- Maintain Property and Make Investments

- Tax Matters

- Government Benefits

- Retirement Benefit Transactions

Agent Powers

If you want to give more powers, you should select the power in the online form, and it will be given to the agent.

Want to restrict the agent? You can do so by mentioning it in the POA form.

How will the agent be compensated financially? Are you going to pay him from out of pocket, at a specified rate or some other specific way?

Do you want to specify how the POA will come to an end? You can choose it to end on a specific date or upon happening of a specified event. Mention the date if you want to end the POA on that date.

Where will you sign this POA? Name the city of Missouri and also mention the date on which the document will be signed. If you want to notarize it, you can.

How will Financial POA Work?

As mentioned earlier, the POA can either become effective immediately or upon the occurrence of a future event. If the POA becomes effective immediately, the agent will start to act on your behalf even if you are not available and are not incapacitated.

At the execution of a POA, the original is given to the agent. He then presents it to the third party as evidence. The POA acts as your agent’s authority to act for you for transactions like withdrawing money from your bank account. But you will continue to be legally obligated to the third party who relies on the POA with your agent.

Create Financial POA at Forms. Legal Now!

Sign up and get a trial subscription for a week. During this period you can create

POA for free. However, if you have to create more legal after this period, get a Pro-Subscription.