Understanding the different clauses commonly found in business partnership contracts is essential when starting a business partnership. By knowing what to expect, you can avoid any potential conflicts down the road.

This blog post will outline the must-have five clauses in your partnership contract, including what each clause means.

Role of Each Partner

-

This clause should clarify the role of each partner in the business like:

-

- The level of involvement

- Decision making

- Financial obligations

If you are starting a business partnership, it’s essential to have a contract that outlines each partner’s expectations and duties. A well-drafted agreement can help prevent disagreements and misunderstandings down the road.

Capital Contribution

This clause should outline each partner’s capital contribution to the business. Often the amount of money or skills a partner has contributed will determine the percentage ownership of the company.

Due to potential future benefits, some companies prefer to have their partners contribute more than just capital. For example, if one partner will provide a service that makes up most of the income for the company, many partnerships require that the contribution be two-fold. The first is an equity contribution, and the second is a fee or salary for the provided service.

Those that contribute more capital get more equity in the company.

Profits and Losses Distribution

This section of the contract explains how the net profit or loss of the business is distributed among partners for tax and other purposes.

It is essential to spell this section clearly, as it can affect each partner’s tax liability and stand in the partnership.

-

Some common methods of profit and loss distribution are:

-

- Profit or loss is split equally among partners

- Partners receive a percentage of profits or losses based on their ownership stake in the company

- Partners receive a percentage of profits or losses based on their investment in the business

- Profit or loss is split up among partners in any fashion agreed upon by all parties

This contract section is crucial to a successful partnership and should be agreed upon before starting the business.

Acceptance and Liabilities

This section should state that the company partners aren’t responsible for any liabilities the company may accrue.

Though not all partnerships include this, it’s a good idea to speak to your attorney if you notice an omission in your contract. It protects both the company and the partners themselves from any disagreements that may arise in the future.

Dispute Resolution Clauses

Dispute resolution clauses are a must in any business partnership agreement. By including them in your contract, you and your partner establish the process to resolve disputes that may arise during your business relationship. It can help prevent disagreements from turning into full-blown arguments and lawsuits.

There are many dispute resolution clauses, but most will specify a dispute process, such as mediation or arbitration. They may also set out specific timelines for resolving disputes and establish rules for how each party will participate in the process.

The clauses in a business partnership contract are essential to have for success. These five clauses will help you determine the best terms and conditions for your company going forward, so they must be included in an agreement between partners.

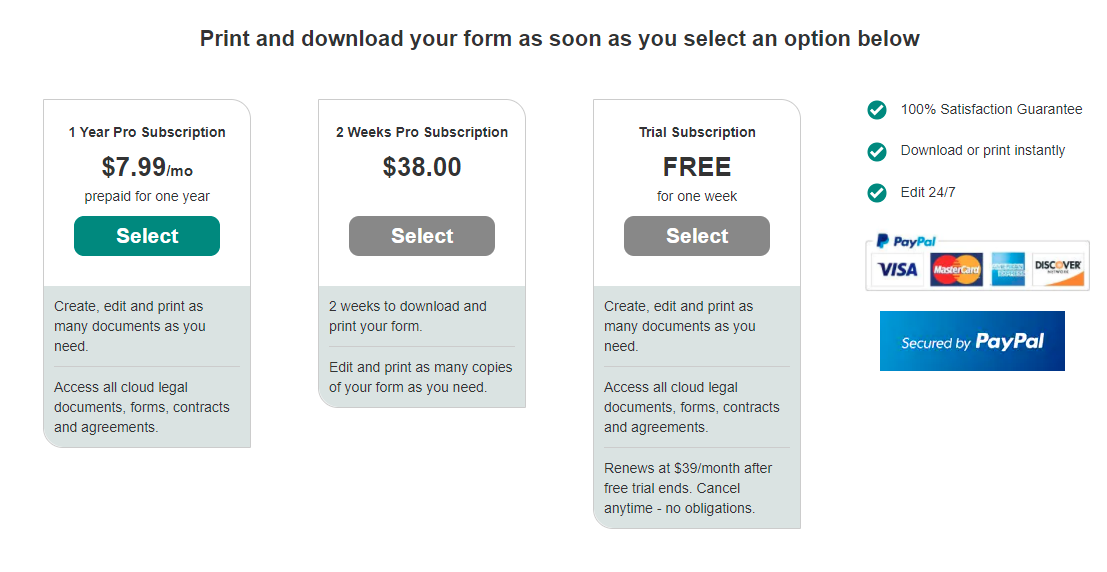

Have any of these clauses been missing from past agreements? If so, now is the time to create them! We offer free partnership agreement template helping you make the perfect business partnership contract based on all of these five key areas. Download Nevada Partnership, Missouri partnership contract or for any other US state here.