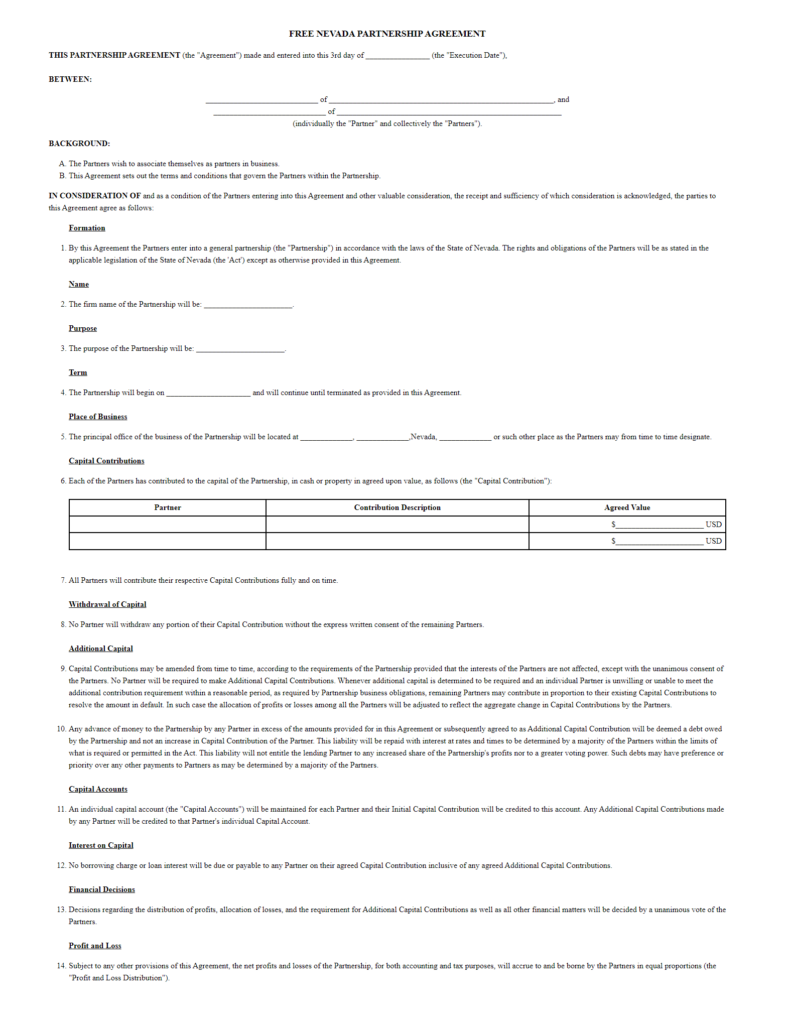

Sample Nevada Partnership Agreement

Steps for Creating a Partnership Agreement in Nevada

Partnership agreement, also called partnership contract or business partnership agreement, is regarded as the glue that’s designed to hold partnerships in place. This legally binding document outlines the rights, roles, and relationships among the partners and also between the partners and the partnership. In the event of a dispute or any source of discord, this agreement comes in and offers guidance on how certain matters are to be resolved.

But this backbone to partnership businesses is not grown out of thin air. For starters, all the parties to the partnership must agree to constitute the partnership with the terms agreeable among them all. Matters regarding the capital contributions before the partnership business kicks off, and any necessary additional capital needed in the course of the business will be outlined in this agreement. Besides capital, steps and methods of dispute resolution, profit sharing, partners' authority, ownership, termination of the partnership, and exit strategies for the partners, among other elements, are covered by the contract. It is, therefore, right to regard the partnership agreement in Nevada as the backbone of a partnership business.

So, if you are working out the logistics for creating your partnership agreement as you determine the best partnership business structure for you, you’ll be happy to know that you can create your business partnership contract with ease and at no extra cost using our free Nevada partnership agreement form. This free partnership agreement template has all the important clauses/ sections you need in your sample business partnership contract. The partnership agreement in Nevada is not a statutory document, but it carries a significant amount of weight in business partnerships, hence the recommendation that every business partnership must have one.

When to cancel the partnership contract

The catch when it comes to partnership contracts, however, is that this spine that holds everything from crumbling might actually crumble or fail to effectuate the effects expected or intended, and when this happens, then the legal partnership agreement requires cancellation.

The partnership agreement might come to an end for a number of reasons, including the need to restructure the partnership, irreconcilable disagreements among the business partners, and in other cases, the cancellation of the contract may be necessitated by the growth of the business.

Regardless of the reason, you need to ensure that you take the right steps when canceling the contract. Among other reasons, you need to take the right steps to limit personal liability over the debts of the partnership, as well as the actions of the other (former) partners.

Steps for Canceling the Agreement

Things to do before you cancel a business partnership contract

Generally, you do not require the consent of the other partner(s) to cancel the agreement. But on the same breath, you need to follow the specific rules or the provisions for exit instituted during the formation of the agreement. Failure to follow the rules could mean that you are liable for penalties. You may also be liable to your partners if you take some missteps.

To be on the right side of things, go over the terms on your leases, and also the loans or contracts you may have signed with your partners.

Remember that all agreements always come with penalties. So, should you dissolve a partnership while obligated to the agreement, you will suffer the consequences. For example, a party to the contract: creditor or the landlord may hold the right to sue should you default on your obligations. Also, sending a notice of the end of the partnership might not be enough to get you out of the obligations to third parties.

Therefore, before you cancel the agreement, you should work around the contracts (preferably with the help of a lawyer) to legally remove yourself from contracts and leases. You could also negotiate for new terms with the creditor to avoid unexpected liability.

Notifications to Third-Parties

From the section above, you’ve probably gathered that the most important step you have to take when trying to cancel a business partnership contract involves sending a notice of the cancellation to third parties. This notification is not only important in keeping you on the right side of things with the other partner(s), but it also limits the chances of being penalized.

Also, like every other contract, you have the obligation of notifying all the parties affected by the cancellation of the contract, especially if you are the one initiating the cancellation. So, go ahead and send professional (read written) notices to suppliers, customers, and vendors. What this notification does is that it informs the third parties that you will not be liable for any future debts or liabilities incurred by other partners.

Partnership Dissolution by the State

Even when your state doesn’t call for this, you need to dissolve your partnership (formally), soon after the termination of the agreement, especially for partnerships registered with the Secretary of State. The formal dissolution often offers an extra layer of legal protection. Keep in mind that you may need a liquidation plan (showing how you intend to settle the debts and the assets of the partnership), along with your dissolution form.

Finally, it’s important to look at the effects of the cancellation on the tax front. Beware of all potential tax consequences and have a plan for handling these consequences.

Whether you are in Henderson, Las Vegas, Reno, Carson City, Elko, Laughlin, Sparks, or any other city in Nevada, we’ll help you get started with your partnership agreement documentation easily. All you need to do is to download our free partnership agreement form today!

Sample

NV Partnership Agreement

Personalize your Nevada Partnership Agreement template.

Print or download in minutes.