Sample Delaware Partnership Agreement

Partnership Agreement in Delaware

Title 8 of Delaware’s Code stipulates that partners in legal partnerships can adopt partnership agreements. This code stipulates that the partnership agreement document details the relationship between the partners; specifically, the general and the limited partners, and their relationship with the partnership itself.

While the law is clear that this partnership agreement is not a legally required document (necessity), it is essential and recommended since it results in seamless operations of the business.

The other names for this document that are recognized by the law include a business partnership agreement, general partnership agreement, articles of partnership, or a partnership contract.

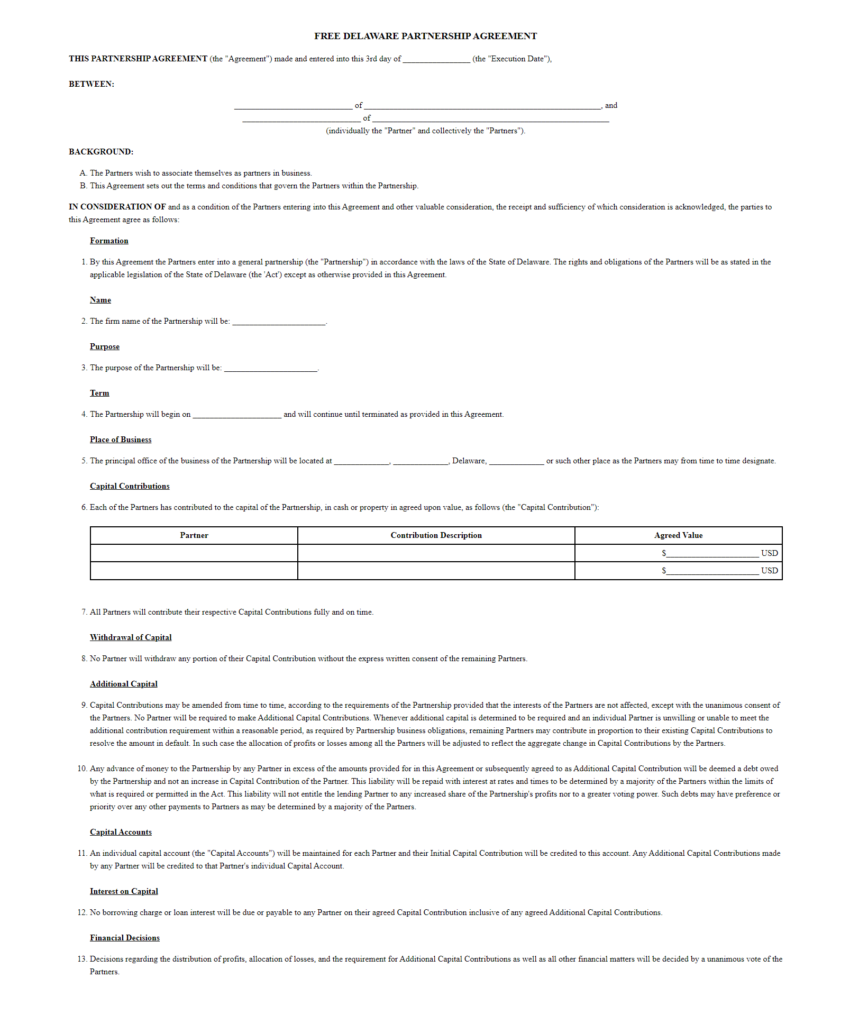

If you are getting ready to draft a partnership contract, the first step you’d take would be to download our printable and editable free Delaware partnership agreement. This legal partnership agreement template offers a detailed overview of what should be in your partnership agreement to not only ensure ease of daily operations but also to improve the success of the business in the long run.

Note that the partnership agreement in Delaware is legally binding, and though it isn’t a necessity, it’s crucial to have it in place. The best bit is that the partnership agreement doesn’t require notarization to be legally enforceable – it only needs the signatures of the partners.

Essential Sections of the Delaware Partnership Agreement

As an agreement between at least two people going into business together, the partnership contract must have clauses that stipulate different functions and conditions that ensure the continuity of the business. These clauses include:

-

- Financial contributions, rights, and the allocation of profits and losses

- Partner authority and responsibilities

- Dispute resolution

- Voting

- Competition and Involvement in business operations

- Partner withdrawal or death

- Dissolution of partnership

-

1. Financial Matters

This clause gives directions on all matters relating to the partners’ capital (and cash) contributions, and the resultant ownership percentage based on their capital contributions.

One of the important financial aspects covered here is the allocation/ distribution of profits and losses. Here, the partnership contract stipulates whether the profits and the losses of the partnership will be distributed based on a fixed percentage (predetermined in the contract), an equal share to all partners, or if the profits and losses will be based on the capital contributions of each partner.

While general partnerships give all partners equal financial rights and obligations, this isn’t an assumption that you want to make in a limited liability partnership since partners can have different rights or obligations, based on their contributions. Therefore, it’s important for the partnership contract to incorporate the rules on financial obligations and perks before the start of business.

The other financial aspect to be covered is the percentage of profits given to the managing partner, as well as any other partner responsible for the daily operations of the partnership.

-

2. Authority

If you’ve settled on an LLP, one of the things you must agree regards the authority of the partners, including what the partners can and can’t do, as well as the legally binding contracts they can get into on behalf of the partnership and the other partners and the contracts they cannot get into. This section further outlines the limitations on the authority of the partners.

-

3. Involvement in the business and Competition

The contract might also include different provisions on matters that relate to the activities and the time spent by the partners taking care of matters affecting the partnership.

Beyond the time and the activities that each partner must give and engage in the business, this section also features provisions and limitations to the abilities of the partners to engage in separate businesses in direct competition with the partnership business.

-

4. Voting

Which matters call for a vote? Are there big issues that can only be resolved or decided through a vote?

Generally, the bigger decisions that call for a consensus among the partners will require a vote. The next step/ section would, therefore, address the number of votes each partner gets. Are the votes dependent on the value of the capital contribution, the profit share, or does every partner ger an equal vote, regardless of their capital contributions?

This clause should also address the items that can be approved through a minority vote and the ones that will only pass through a majority vote.

-

5. Tax Elections

The IRS treats partnerships as taxable entities, auditing these businesses at the partnership rather than the individual level. With this in mind, the partnership contract should address matters on tax elections and name a tax representative for the partnership. The representative named should be eligible and qualified since they will be required to represent and act on behalf of the partnership.

-

6. Dispute Resolution

Another crucial clause in the business partnership agreement is the one that addresses the resolution of disputes between the partners. For the protection of the partnership’s interests, the contract must have a mediation clause to compel the partners to seek professional mediation services from independent/ certified third parties to help in the resolution of the conflict.

-

7. Partners’ Withdrawal, Termination or Death

Here, the legal partnership contract stipulates the conditions to be met for withdrawal from the partnership, handling of the withdrawing partner’s stake, and the buyout processes, where necessary.

This clause also addresses the steps following the death of a partner, as well as the actions that would necessitate the termination of a partner’s stake in the partnership.

-

8. Dissolution of Partnership

This section of the contract stipulates the conditions/ terms for the dissolution of the partnership. Some of these conditions include the death of a partner, bankruptcy, or meeting set goals.

Interested in creating a partnership agreement document in Dover, New Castle, Wilmington, Newark, Rehoboth Beach, Lewes, Milford, or any other city in Delaware? Download our free partnership agreement form here, now, to get started.

Sample

DE Partnership Agreement

Personalize your Delaware Partnership Agreement template.

Print or download in minutes.