Sample Texas Bill of Sale

You Can Now Get a Texas Bill of Sale Form for Free

If you are selling a horse, puppies, furniture, a vehicle, or a boat in Texas, then you are in luck because you can process the sale at no extra cost by downloading a free Texas bill of sale form from any city.

The forms have fields to be populated with details of the transaction and the parties involved. But, before we jump into the details that should be entered in the BOS, a look at what the document is and how it differs from invoices given in stores of purchase and sale agreements.

A bill of sale represents the legal instrument used to document the sale of personal property from a seller to a buyer and the subsequent transfer of ownership and obligations for the property.

The state of Texas recognizes two parties in the BOS, the seller and the buyer. These parties have to put down their identification details in the BOS as they appear in the state ID and the driver's license. Through a bill of sale which is signed by the seller and the buyer at the completion of the transaction, the seller, the bill of sale absolves a seller from any liability, and it can be presented in court as evidence. It could be used to register the asset as well.

On the other hand, you have the sale/ purchase agreement which is an agreement that the buyer and the seller come up with to pay for the property sold by the seller at a later date. Though it triumphs the BOS in that it could be used in real estate settings, the agreement doesn't hold any power to transfer ownership, and it is not a proof sale.

An invoice differs from the BOS in that a retailer draws it and it is not necessary for the seller and the buyer to sign it. However, it grants the buyer ownership.

For the BOS to protect a seller from complete liability, the seller may create and sign a seller's disclosure which will protect the seller from any liability. Once the buyer reads the details of the seller's disclosure and goes ahead to put down their signature, they cannot sue the seller.

Besides the dated signatures of the seller and the buyer, the BOS must have the details of the sale (including whether it is a sale or not), any terms of sale, and the date the BOS comes to life and when the buyer pays the purchase consideration. It should also carry the unique details of the named property on sale as well as the date of a previous owner if the seller purchased that item from someone else.

Depending on the type and the intended use of the BOS in Texas, it may or may not require notarization.

Keep in mind that you should always keep a copy of the BOS because the buyer gets to take home the original BOS as they may need it to register the property under their name.

So, which type of BOS and free bill of sale form in Texas should you get?

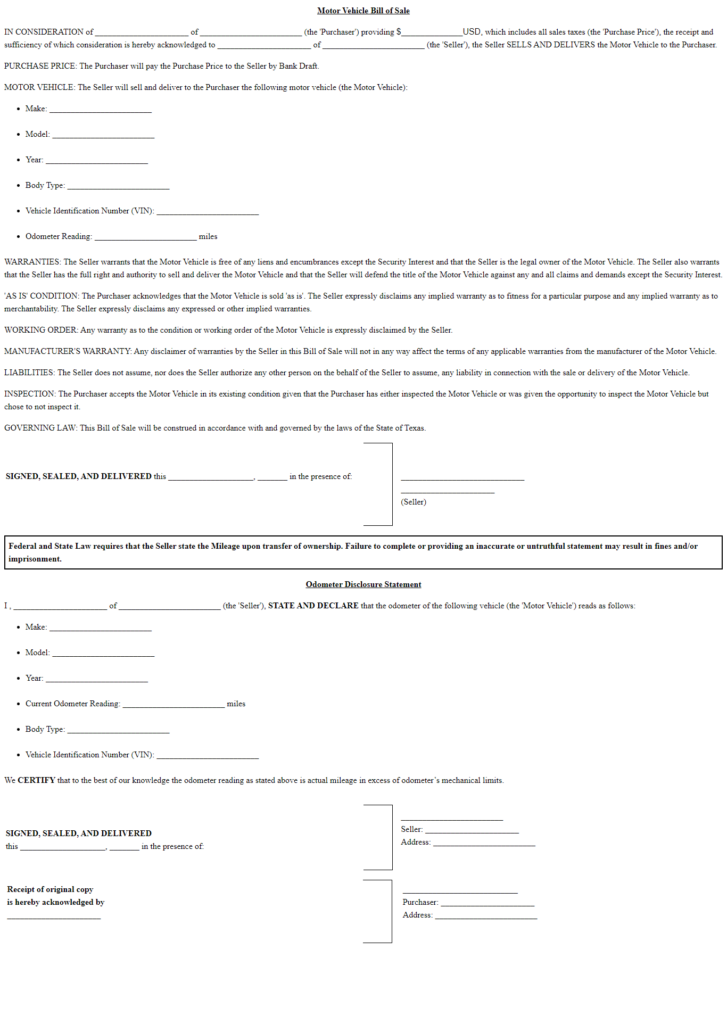

What are The Requirements of The BOS for Motor Vehicles?

Once you have the BOS for motor vehicles, you will have to fill it with appropriate details of the sale, parties involved, and the description of the item on sale.

In details, you need:

Buyer and seller information: this is where you indicate the name of the buyer and the name of the seller. You also have to indicate the mailing addresses of the seller and the buyer; the addresses should be the mailing rather than the P.O BOX address and should have the state and the city information. The state of Texas also requires the incorporation of the seller' and the buyer's driver's license numbers. The county of residence should also be listed in the BOS.

The vehicle's details: in this section, you input the vehicle's odometer reading, the registration ID, the title number, make, model, color, and the fuel capacity.

The purchase consideration: how much is the buyer paying for the vehicle? Is a trade involved? What are the terms of the trade? The date that the seller receives the payment should also be indicated.

Dated signatures: the seller and the buyer have to sign and date the BOS in the presence of a notary public because the BOS is necessary for the registration of the vehicle.

The department of motor vehicles in Texas will require you to fill out Form VTR-40 - the odometer disclosure statement with the vehicle's mileage. This form must be filled out within 30 days after the BOS's notarization.

Which are The Requirements for a Business BOS

To transfer your ownership stake in a business, you have to prepare a BOS which outlines the selling price of the business. This BOS will also have information about the buyer and yours, in detail.

But, before the buyer signs this document, you have to hand over the financial statements of the business and the balance sheets spanning that last 3 or 4 years. You have to give them revenue and tax details for the same duration, as well as contracts, operations manuals, employees information, insurance and assets' details, among others. Nondisclosure agreements are also necessary.

Once satisfied, the buyer will pay the purchase consideration and both parties sign the BOS at the notary public to formalize the sale.

Using The BOS to Sell a Boat

Other than the name of the seller and the buyer, as well as their physical addresses, the BOS for boats must have the driver's license numbers of the parties.

For the boat, the seller should input the boat's make, model, year, manufacturer, title number, Hull ID, registration number, and the odometer readings.

It should also be made clear whether the boat is sold with the outboard motor and the trailer or not. If the trailer is part of the sale, note down the length, make and year. If sold with the motor, indicate then horsepower, make and year.

The purchase consideration should be in words then listed in numbers.

The date the BOS comes to life, and the agreed date for the payment should be indicated as should the seller disclosure (spelling out the defects of the boat as per the seller's knowledge).

Both parties must sign this BOS at the notary public.

Which BOS do you need in Texas? Get our free bill of sale forms at no cost today.

Sample

TX Bill of Sale

Personalize your Bill of Sale template.

Print or download in minutes.