Sample Bill of Sale

Why Use a Bill of Sale Form?

A Bill of Sale (BOS) is a legal document that serves as proof of sale or transfer of ownership of personal property from one party to another. Bills of Sale are used for transferring valued assets such as vehicles, boats, equipment, aircraft, firearms, branded animals and other personal property.

BOS Is More Than Proof of Purchase

A Bill of Sale is not the same as an Invoice or a Receipt. It is more than proof of purchase. This is a legally binding document of the transaction that protects both Buyer and Seller from fraud, theft and mistakes. A completed BOS proves validity of purchase, ensures that it is genuine, and that the price paid is the same as the Buyer claims.

Wondering If You Need a BOS?

A BOS is typically issued by the Seller to the Buyer, at the time of the transaction. It is quick and easy to create a Bill of Sale above that you can preview, print out and you can even email it back and forth. Use our free on-line samples and templates that cover all necessary information to protect you in case a dispute about the transaction arises later on. Simply fill in the form above to begin.

What is a DMV Bill of Sale?

Many states require a completed Auto Bill of Sale, also known as a DMV Bill of Sale, before you can register the vehicle or transfer a vehicle title. A Bill of Sale is particularly important, should anything go wrong with the vehicle that the Seller knew about, but failed to notify the Buyer. The information contained in the BOS can be compared to a vehicle history report to ensure that the vehicle history is accurate. Sales tax will be calculated based on the purchase price listed on the BOS.

This document does not replace a title transfer. Many states require that an Auto Bill of Sale includes an Odometer Reading; some states require it to be notarized.

Other Types of BOS

While people most often use a B<><>OS for used cars, there are other types of BOS to document the sale of other kinds of personal property such as a laptop, bike, snowmobile, firearm, boats, pets and animals, and furniture—any of which can created free using the form above.

What Does It Mean to Sell an Item on "As-Is" Basis?

By selling an item "as-is," it means that the item is on sale in its current condition, including with its faults, with or without warranty, and with or without some accessories. By indicating that a sale is "as-is", a Seller is safe from a legal suit should the Buyer encounter problems with their purchase. It means that the Buyer will shoulder repair costs if the purchased item breaks down soon after purchase. However, a Seller needs to indicate that a sale is on this condition to avoid problems in future.

However, most Sellers include a limited liability on sales, to sweeten deals. If you choose to include limited liability, specify what the warranty covers and what it does not.

-

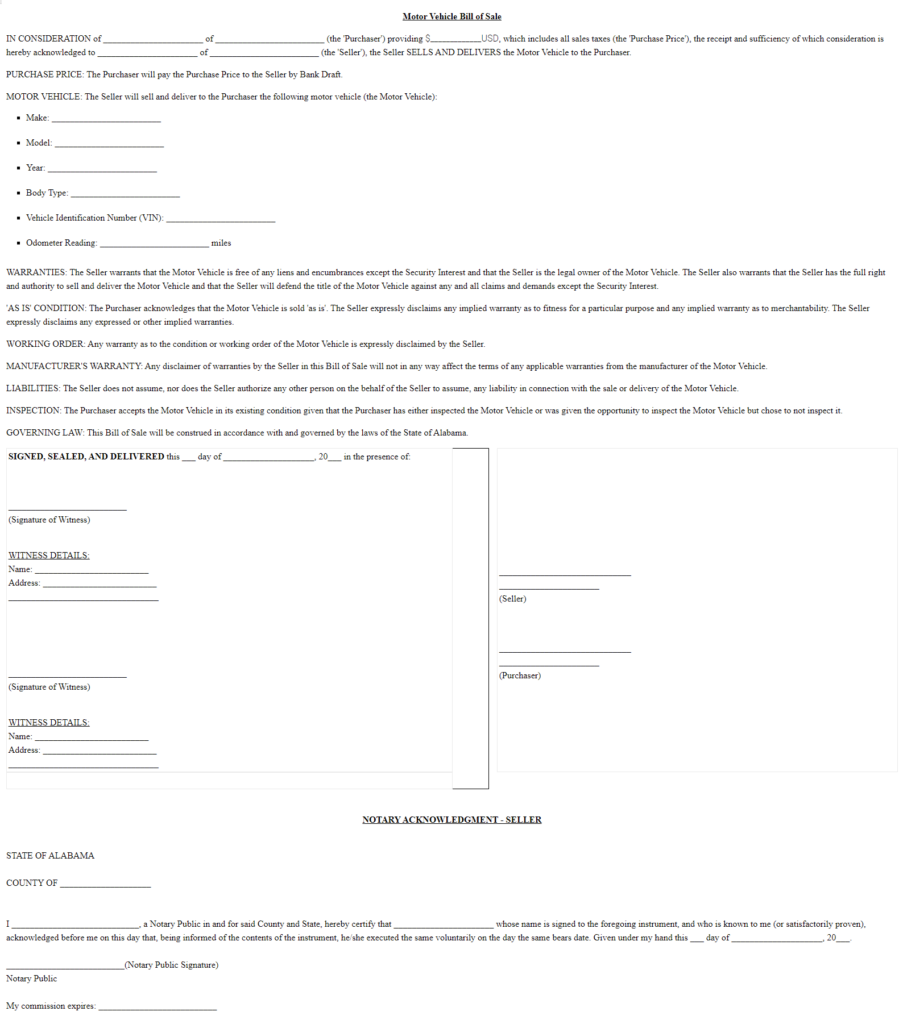

Though the details vary depending on the item in question, here are the basic details for a generic bill of sale:

-

-

Names and addresses of the Buyer and the Seller, as well as their contact information

-

The date of the transaction

-

The purchase consideration

-

The date of payment

-

Type of transaction: cash sale/trade/gifting

-

Terms and conditions of the sale/purchase

-

Warranty information if available

-

The description of the named item

-

The Seller’s disclosure, if any

-

The dated signatures of the Seller and Buyer (if needed)

-

Acknowledgment by the notary public (if necessary for registration of the item)

-

What Are the Acceptable Details Under the Description of the Item On Sale?

-

-

The serial number for equipment, furniture, aircraft, electronics, engines, boats, trailers, or bicycles.

-

Registration or identification numbers for watercraft, vehicles, aircraft and motor vehicles. This applies to branded animals too.

-

Odometer readings for vehicles, car, motorcycles, and watercraft

-

Color: this applies to any asset on sale

-

Make, model, or year: for vehicles, car, watercraft, aircraft, electronics, and equipment

-

Selling price

-

Are There Circumstances for Not Using the Bill of Sale?

-

Yes. You do not use the BOS for

-

-

Sale of small items: you don’t need a BOS when selling low-cost items like cups or an old rug.

-

Real Estate transactions: these transactions are more complicated, and you have to use different types of property forms often available through local or the state government only

-

Services transfer: The BOS is only valid when transferring ownership of assets-not for services performed

-

Get your free equipment bill of sale sample form, property bill of sale PDF, and sample vehicle bill of sale for car—all in one place! Learn what a DMV bill of sale is and download legally binding templates today!

Sample

Bill of Sale

Personalize your Bill of Sale template.

Print or download in minutes.